FRONTIER MARKETS SHINE IN OCTOBER

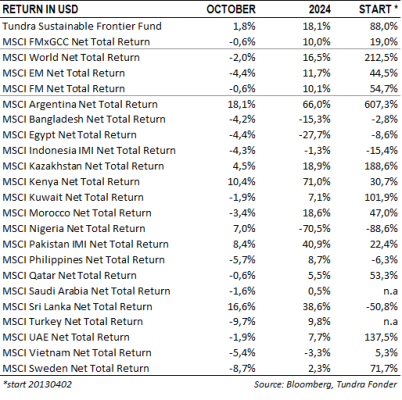

In USD, the fund rose 1.8% during October (EUR:+4.8%), compared to the MSCI FMxGCC Net TR (USD), which fell 0.6% (EUR:+2.3%), and the MSCI EM Net TR (USD), which fell 4.4% (EUR: -1.7%). In absolute return, it was primarily Pakistan (+1.7% portfolio contribution), Sri Lanka (+0.7% portfolio contribution), and Egypt (+0.4% portfolio contribution) that contributed positively. Among negative contributions, it was mainly Vietnam (-0.5% portfolio contribution) and Bangladesh (-0.4% portfolio contribution) that contributed negatively. Relative to our benchmark, it was primarily our overweight in Pakistan (+1.3% portfolio contribution relative to the benchmark), stock selection in Vietnam (+1.0% portfolio contribution relative to the benchmark), and overweight in Sri Lanka (+0.5% portfolio contribution relative to the benchmark). Negative contributions versus the benchmark were mainly received from a lack of holdings in Iceland (-0.5% portfolio contribution relative to the benchmark) and Kenya (-0.3% portfolio contribution relative to the benchmark).

The biggest single contribution came from Pakistani IT company Systems Ltd (7% of the portfolio), which rose 22% after a quarterly report that beat expectations. The stronger rupee and start-up costs in connection with the company’s expansion abroad (primarily Saudi Arabia and Egypt) have weighed on the company’s margins in the past year. Rising resource utilization in the new offices, combined with the company ending some local contracts with low profitability meant the trend broke, while revenue growth remained strong (28% in USD). The second largest contribution was received from Egyptian dairy and juice producer Juhayna Foods (3% of the fund). The stock rose 21% after Arla, a Danish-Swedish dairy giant, made an acquisition bid for a local cheese producer. The biggest negative contribution came from Vietnamese industrial conglomerate REE Corp (7% of the fund), which fell 7% in a weak Vietnamese market.

IMPORTANT MARKET EVENTS

After the initial optimism in Bangladesh after the regime change, the stock market has fallen back on the realization that the country still has some way to go to get out of the ongoing crisis. During October, as expected, the central bank raised its key interest rate by 50 basis points to 10%. Inflation in September fell to 9.9% year-on-year in September, compared to 10.4% in August but remains uncomfortably high. Our two holdings, BRAC Bank and Square Pharmaceuticals, have fared relatively well, both delivering good results for the third and second quarters respectively during the month. BRAC’s third-quarter profit rose 70% year-on-year, primarily driven by higher returns on investments. The stock is currently valued at a P/E of 8.3 on rolling twelve months, compared to its ten-year average of 12.8x. Square Pharmaceuticals delivered results for the second quarter of 2024 (the last quarter for 2024 in the company’s broken fiscal year). Profits rose 17% during the quarter (10% for the full year). The stock is currently valued at 9.6x annual earnings on rolling twelve-months earnings, compared to an average valuation of 15.7x over the past ten years.

During the month, Kazakh fintech company Kaspi announced an acquisition bid for 65% of Turkish e-commerce company Hepsiburada. Kaspi is paying USD 1.1 billion, valuing Hepsiburada at USD 1.7 billion, just under half of the introductory price from 2021. The deal is pending regulatory approval. Assuming approval, the deal will be an interesting experiment on whether Kaspi’s extremely profitable business model can be transferred to other markets. It is currently too early to comment on the likelihood, but of course it could potentially change the image of the company. Although September’s short seller attack was a bad example of throwing a lot of unsubstantiated accusations, the company’s geographical focus on Kazakhstan, and what appears to be limited growth opportunities, are likely key factors as to why the company trades at significantly lower multiples than its international peers.

___________________________________

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you will be able to recover all of your investment. Historical return is no guarantee of future return. The Full Prospectus, KIID etc. are available on our homepage. You can also contact us to receive the documents free of charge. Please contact us if you require any further information: +46 8-5511 4570.