A FIRST MONTH OF RECOVERY

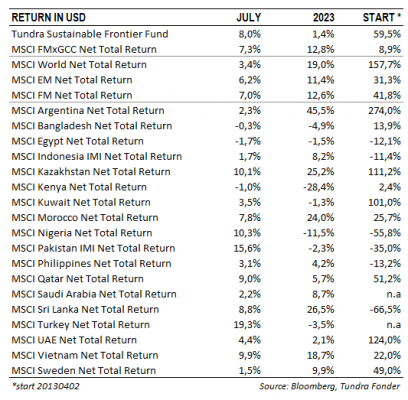

In USD, the fund rose 8.0% (EUR: +6.8%) during the month, compared to our benchmark MSCI FMxGCC Net TR (USD), which rose 7.3% (EUR: +6.1%), and MSCI EM Net TR (USD), which rose 6.2% (EUR: +5.1%). It was a month where we saw a more uniform recovery in several of our markets, partly for different reasons but with the common denominator that an overly pronounced pessimism eased somewhat. In USD, at the country level, the largest positive contribution was received from Pakistan (3.0% portfolio contribution). Our sub-portfolio rose just below 20% during the month, and the fund’s largest position in the banking sector, Meezan Bank (3.2% of the portfolio), rose a whopping 53% and was the fund’s single most positive contribution. The second largest contribution was received from Vietnam (+2.9% portfolio contribution), where our sub-portfolio rose 11% during the month. The biggest contribution came from the fund’s largest position (9% of the portfolio), Vietnamese IT company FPT, which rose 15% during the month. Further, a positive contribution was received from Kazakhstan, where our only exposure in the fintech company, Kaspi, rose 15% during July. The only sub-portfolios that provided negative returns during the month were Bangladesh and Morocco, but the negative contributions were minimal (>-0.2%).

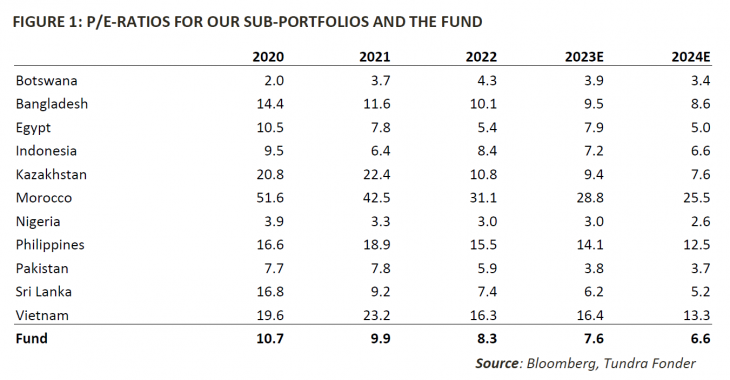

It was an eventful month in Pakistan. The sitting coalition government publicly announced that the incumbent government will be dissolved in August and replaced by a temporary interim government which partly cleared the political uncertainty. During the month, Pakistan received a total of USD 4 billion from the IMF, Saudi Arabia, and the United Arab Emirates. This gave a strong signal of confidence and was interpreted by the market that there was an acceptable plan to govern the country after the elections in the autumn. Furthermore, Pakistan announced a comprehensive plan of various projects intended to attract foreign direct investment from the Gulf countries in the coming years in areas such as agriculture, mining, energy, IT, and defence sectors. During the month, four state-controlled energy companies signed a letter of intent with Saudi Aramco regarding the construction of a USD 10 billion refinery. The handling of the opposition party PTI has created major question marks about the country’s way forward. Given this month’s event, however, it seems that the path Pakistan has chosen has been accepted by international organizations (IMF) as well as the country’s traditional allies, the Gulf countries, and China. Although it is still uncertain how the new government will be formed, it appears clear that there is a relatively broad plan that is supported by various stakeholders and that a disaster scenario like Sri Lanka can be avoided. Foreign investors returned to the stock market in July. The net inflow of USD 22m is the single largest since the end of 2021. We believe the stock market has the worst behind it and will gradually find its way up to more normal valuations from here. It’s a bit further to go, however. The current valuation of P/E 4.6x and P/BV of 0.8x should be set against the 5-year average of 6.9x and 1.0x, respectively, and the 10-year average of 8.9x and 1.4x.

In Sri Lanka, the central bank cut the interest rate by another 200 basis points during July. This follows the reduction of 250 points during June. Inflation for the month of July fell to 6.3% (from 12% in June). Above all, base effects (high comparative figures) and lower food prices were behind the drop. However, it should be noted that the currency has recently weakened to 319 versus the US dollar, from peak levels of 290 at the end of May, which will affect import prices upwards and may have a certain effect on inflation.

With another one of our major markets (Pakistan) appearing to have passed the crescendo of the crisis for this time, we remain positive for the second half of the year. Our portfolio companies’ valuations are generally low to very low from a historical perspective, while the portfolio companies are now gradually entering a more stable environment with fewer shocks and better opportunities to focus on growing their businesses. In the long term, the fund’s markets offer superior growth potential. We hope that we have entered a period where this will be reflected in our unitholders’ returns.

___________________________________

TUNDRA SUSTAINABLE FRONTIER FUND REPLACES THE SWAN WITH THE EU’S REGULATIONS FOR SUSTAINABILITY

In connection with the new EU regulation under the Sustainable Finance Disclosure Regulation (SFDR), new requirements are applied to funds’ sustainability work as of March 2021. Tundra has therefore decided on July 4 not to continue with the Nordic Ecolabelling of the fund. According to the new regulations, sustainability reporting must take place in a uniform manner and funds are divided into different categories. The Tundra Sustainable Frontier Fund is classified as an Article 8 fund (Light green: promotes environmental or social characteristics). The investment philosophy of the fund remains the same; management of the fund and is not affected by the change.

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you will be able to recover all of your investment. Historical return is no guarantee of future return. The Full Prospectus, KIID etc. are available on our homepage. You can also contact us to receive the documents free of charge. Please contact us if you require any further information: +46 8-5511 4570.