FUND PERFORMANCE

The fund rose 4% in USD (+5.2% in EUR) in January, compared with MSCI FMxGCC Net TR which rose 0.9% in USD (+2% in EUR), and MSCI EM Net TR which rose 3.2% in USD (+4.5% in EUR). Half of our outperformance came from Pakistan, while Vietnam, Sri Lanka, Egypt, Bangladesh, and the Philippines all contributed relatively evenly to the remaining alpha. Negative relative returns were obtained from our underweights in Morocco, Romania, and Kenya. Among individual holdings, Sampath Bank (Sri Lanka) stood out, rising almost 50% during the month, a large part of it after announcing a share split (3:1). Nearly 4% of the company’s shares traded on the day after the announcement, which is another sign of local investors’ newfound appetite for the equity market. The move might be considered irrational, but it should be noted that even after the rise, the bank is still valued at a 15% and 33% discount, to its average 5 and 10 years P/BV valuation respectively. The sharp move comes from low levels. Significant contributions were also received from two of the fund’s largest positions, Systems Ltd (Pakistan) and Square Pharma (Bangladesh), both of which rose around 10% during the month. These three shares together accounted for about half of the fund’s absolute return during the month. Negative contributions were received from Asiri Hospitals (Sri Lanka), which retreated after the sharp rise in the previous month. During the last day of the month, we had the opportunity to meet with the company’s management through an online meeting. After a couple of years with fairly heavy investments, the company is now entering a harvest period where profitability is likely to rise as the new capacity is filled. At the same time, the lower corporate tax (14% vs previously 28%) and lower interest costs mean that profit growth will be strong. We expect earnings per share to rise by just over 50% for fiscal year 2021 (ending March 31, 2021) and thereafter a further 80% for FY22. Based on our estimate for FY22 (ending March 31, 2022), the company is valued at around 15x earnings. It is still relatively low given our expectations of continued margin improvements FY23-24.

We were unusually active on the trading side during the month and carried out some repositioning. We sold our last traditional cyclical exposure, the Vietnamese steel company Hoa Phat Group. It is probably the most well-run steel company in the frontier universe and it has a fantastic momentum in the business with good demand and rising margins. However, the valuation has skyrocketed and we sold at a time when the company’s P/BV valuation touched two standard deviations over both the 5-year average and the 10-year average. As you know, traditional cyclical investments such as steel and cement are not typical Tundra-investments. This is due to the fact that their margins over time are largely affected by factors beyond their control (they are price takers both on the products they sell, as well as the input materials they need). When we own cyclical shares, it is usually early in the cycle when pessimism is high and the shares are trading at low valuations relative to their average earnings over a cycle. We reallocated parts of the capital to REE Corp, which is something as unusual as a renewable energy case in Vietnam. From a background as a manufacturer of air conditioners, it has gradually developed into one of Vietnam’s leading technology consultants (water supply and infrastructure) and in parallel developed a high-quality property portfolio in central Ho Chi Minh City. In recent years, the focus has added a portfolio of projects in renewable energy (water, wind, and solar). REE was one of the last physical meetings we had on-site (January 2020) and we were impressed by the management’s historical ability to show steady growth and their vision for the future. Most of us have noticed the strong demand for companies involved in renewable energy in developed markets which have pushed the prices of those companies to sometimes astronomical levels. Here we have found a reasonably valued company (P/E 10x) in the sector, with a great and trustworthy management and operating in one of the world’s fastest-growing economies. We look forward to following REE Corp’s long-term journey as shareholders.

Our second new position was in the Egyptian dairy and juice producer Juhayna, which we have owned in the past. The share has been under pressure from general weak performance for Egyptian shares but also by headlines about the owner family who are rumoured to be forced out of the company. In our assessment, we believe that the impact on the company’s fundamental development will be marginal even if the rumours turn out to be true. After a couple of tough years with large investments, including several new brands, we think the company is well-positioned for some decent years ahead. This at the same time as the share has halved in the last two years. The valuation of just over 10x for expected 2021 earnings appears to be low for a leading dairy producer in a fast-growing market like Egypt.

During the month, we also took an initial position in Philippines’ second-largest food-retailer, Puregold. In our view, it’s currently the best food retailer. We prefer the branding and the investment plans over the other larger listed food retailer, Robinson Retail. We believe Puregold will be able to compete successfully also against the dominating SM Group, whose food retail expansion has been very much about following the parent company’s establishment of large shopping centres. This path of expansion might be more cumbersome in the long run. The Philippines has suffered badly from the COVID-19 pandemic, as it belongs to the group of countries in Asia with the strictest restrictions. This has also put pressure on Puregold, now trading two standard deviations below its average P/BV valuation for both 5 years and 10 years. It’s a good opportunity for us to take an initial position in a company with good long-term growth prospects and stable profitability. Including the positions in Juhayna and Puregold, Consumer Staples now make up 16% of the fund’s assets which is the highest weight for us since mid-2014. Those who have followed our monthly letters recall that for several years we have had difficulty finding interesting investment opportunities in the sector, despite being long-term positive towards the sector. We note that the valuations after several years of outflows from our markets have come down, allowing us to buy fairly long-term growth prospects at reasonable valuations.

MARKET NEWS

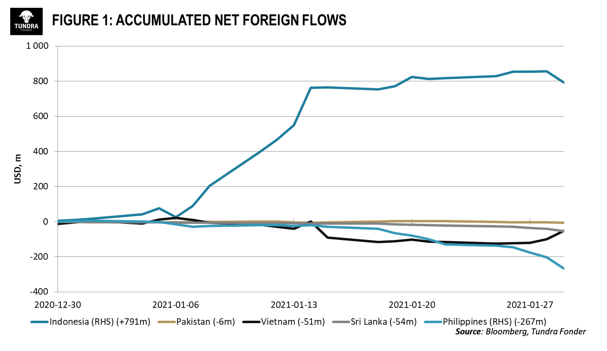

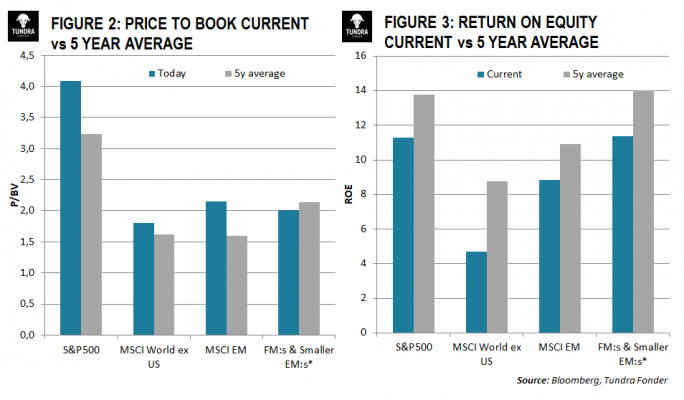

MSCI FMxGCC Net TR rose 0.9% in USD (+2% in EUR) during the month, compared to MSCI EM Net TR which rose 3.2% in USD (+4.5% in EUR) and MSCI World Net TR which decreased -0.8% in USD (+0.3% in EUR). The best-performing markets during January were Sri Lanka (+11.7% in USD, +13% in EUR) and Bangladesh (+8.2% in USD, +9.5% in EUR). Vietnam (-2.6% in USD, -1.4% in EUR) was the only major market to fall during the month. In Tundra’s expanded universe, we noted that Egypt (+7.7% in USD, +9% in EUR) and Pakistan (+4.4% in USD, +5.6% in EUR) performed well, while the Philippines (-8% in USD, -6.9% in EUR) and Indonesia (-2.4% in USD, -1.3% in EUR) had a tough month. In both Bangladesh and Sri Lanka, local investors continued to drive stock markets in the wake of lower interest rates. Vietnam has also seen a phenomenally high turnout from local investors, but the market panicked towards the end of the month after a new outbreak of COVID-19 in the northern parts of the country. The Philippines had its worst month since March 2020. The country is the hardest hit in Asia with restrictions not far from what we have seen in a number of European countries. GDP for the fourth quarter fell 8.3% year-on-year, which is likely to be the worst in Asia when all numbers are in. Since the US presidential election, we have noted inflows to emerging markets. With the exception of Indonesia, however, we have not yet seen these reach the smaller emerging markets and frontier markets. As can be seen in the figure below (see Figure 1), the Philippines, Sri Lanka, and Vietnam have seen continued outflows. In Pakistan, we have seen a period of neutral flows, while Indonesia has seen decent inflows. We have seen a strong recovery in most of our equity markets since the bottom at the end of March. So far, however, the recovery has been exclusively driven by local investors. When we compare our markets (here referred to as FM & Smaller EM:s) with the S&P 500, MSCI World ex USA and MSCI EM, we find that our markets remain the only ones that continue to trade at a discount compared to their 5-year average (see Figure 2). If we look at return on equity, we find that an unweighted average of our largest markets has the same return on equity as the S&P 500 both today and as an average for the past 5 years (see Figure 3). In other words, the improved market sentiment since the end of March has so far only been a recovery to average long-term levels. We are quite far from the stage of enthusiasm at this point in time.

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you will be able to recover all of your investment. Historical return is no guarantee of future return. The Full Prospectus, KIID etc. are available on our homepage. You can also contact us to receive the documents free of charge. Please contact us if you require any further information: +46 8-5511 4570.