THE FUND

The Fund rose 4.5% in April, better than the benchmark index MSCI EFM Africa ex South Africa Net Total Return Index, which rose 3.1%. So far this year the Fund has fallen by -18.4%, better than the benchmark index which has fallen -19.1%. At a country level overweights in Nigeria (19% of fund assets) and overweights in Egypt (42%) contributed most positively relative to the benchmark. The Fund’s underweights in Kenya (4% of fund assets) and underweights in Senegal (0%) contributed most negatively. At the sector level, overweights in Financials along with overweights in Consumer Discretionary contributed most positively, while the underweights in Communication Services and overweights in Health Care contributed most negatively relative the benchmark index. The Swedish krona strengthened 2.3% versus the USD in April, decreasing the SEK return of the Fund (all changes in SEK).

Several of our holdings, mainly financials, have released Q1 results with mixed results. Keeping in mind that most of Q1 was business as usual, most companies started to see an impact from COVID-19 in March. Loan growth was hence decent around 10% for our Nigerian banks, but due to potential non-performing loans provisions increases between 50% to 150% versus Q1 last year, profits were flat or even slightly negative. CIB in Egypt increased provisions by 140% while recording only 3% loan growth and profits declined by almost 10%. Standard Chartered Bank in Ghana stood out and delivered 35% loan growth and while provisions doubled, profits grew by 25% in the first quarter. We expect Q2 numbers to be worse for almost all our holdings and then recovers slowly for the rest of the year, with a lot of uncertainty attached to that outlook.

No major changes were made in the portfolio last month.

MARKET

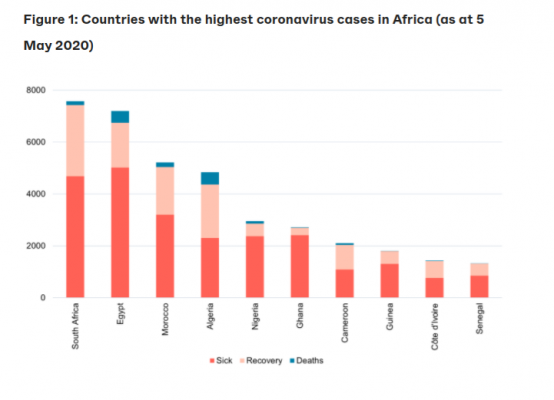

African equity markets in April (MSCI EFM Africa xSA Net TR +3.1%) recovered slightly but performed worse than other Frontier markets (MSCI FMxGCC Net TR), which rose 5.4% during the month. South Africa was the best African stock market rising 10.7% followed by Egypt, rising 9.1%. Tunisia was the worst African market declining 6.5% while Zambia was the second-worst performer, falling 6.4%. The stock market recovery in Africa was less pronounced compared to developed markets in general and the US in particular (S&P 500 rose 10.5% in April) being late in the COVID-19 virus spread. (all changes in SEK)

Egypt (Hermes Index +9.1% in April, -16.9% year to date) cut GDP projection for FY20/21 to 3.5% if pandemic ends by June and to 2% if pandemic continues to end of the year. Blue chip bank CIB supported that view changing the earlier outlook of capex-lending recovery in Egypt in 2020 to maybe 2021 or even 2022. Parts of the economy will see fewer restrictions in May, with e.g. hotels being allowed to open again (but without any international flights activity will continue to be low).

Nigeria (Nigeria Stock Exchange Main Index +6.9% in April, -12.2% year to date) started to ease on earlier imposed restrictions in parts of the country, allowing more movement but still with nightly curfews. IMF approved the largest crisis support package so far and disbursed USD 3.4bn at the end of the month, helping the country funding the budget gap from a decrease in oil prices and a slowdown in the economy due to the COVID-19 spread. Negotiations with the World Bank and African Development Bank for another USD 2.5bn and USD 1bn are said to be ongoing but not yet finalized.

Kenya (Nairobi All Share Index +2.8% in April, -15.1% year to date), Ghana (GSE Composite Index -5.2% in April, -2.9% year to date) and Morocco (MASI Free Float All Shares Index -2.2% in April, -21.4% year to date) all continue to struggle, like most other countries, with stopping the COVID-19 spread and at the same time supporting the economy. Ghana became the first African country to ease on restrictions, but schools are to remain closed and public gatherings are still not allowed. Earlier Ghana cut its GDP forecast for 2020 to 1.5% from 6.8% (the lowest growth rate in over 35 years).

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you will be able to recover all of your investment. Historical return is no guarantee of future return. The Full Prospectus, KIID etc. are available on our homepage. You can also contact us to receive the documents free of charge. Please contact us if you require any further information: +46 8-5511 4570.