THE FUND HELD UP WELL DURING A WEAK MONTH

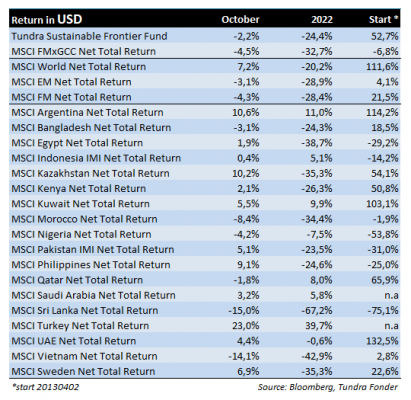

In USD the fund fell 2.2% (EUR: -3.4%) during the month, compared to MSCI FMxGCC Net TR (USD) which fell 4.5% (EUR: -5.6%) and MSCI EM Net TR (USD) which fell 3.1% (EUR: -4.3%).

During a generally weak month, the fund outperformed the benchmark. The main reason was our exposure to Pakistan (20% of the fund), where the sub-portfolio rose 10% in USD and contributed 2%-points (USD) to absolute returns. The primary value driver was the fund’s largest holding, IT company Systems Ltd, which rose 22%. The run-up came in anticipation of its third-quarter report and the stock continued climbing post the results. Systems maintain very high growth, with sales for the quarter up 118% YoY (local currency), and 42% QoQ. Earnings per share rose 107% YoY and 22% QoQ.

The other reason we outperformed the market was our stock selection in Vietnam. We have stayed out of the banking sector and real estate developers, which have been hard hit by a corruption scandal (read more below).

The largest negative contributions came from Egypt, where the Egyptian pound was devalued by a further 20% vs the USD, taking the total devaluation to approximately 35% in 2022. However, the devaluation coincided with the announcement of a new financing package from the IMF, which meant that the stock market recovered towards the end of the month. The events in Egypt are a reminder that even though commodity prices have come down significantly in recent months, import-dependent countries continue to suffer. Egypt is one of the countries that has historically attracted relatively large foreign investments to the fixed-income market, investments that in the past year have been partially brought home given the turbulence around the world.

One of the fund’s largest holdings, Egyptian auto manufacturer and fintech GB Auto, rose nearly 20% in local currency after announcing a potential sale (pending regulatory approval) of 7.5% in fintech subsidiary MNT Halan. The potential sale proceeds of at least USD 60m (which can potentially increase to USD 71.3m pending certain milestones) can be compared with the company’s market capitalization, which is currently approximately USD 150m.

After the sale, GB Auto would own 49.5% of MNT-Halan which is valued at at least USD 800m in the latest transaction. GB Auto’s remaining shares in MNT-Halan can thus potentially be worth significantly more than GB Auto’s current market capitalization.

In addition to the events in Egypt, it was a relatively eventful month in several of our markets. Pakistan has eventually been removed from the so-called “grey list” of countries drawn up by the Financial Action Task Force (FATF), which is an international organization combatting money laundering and financing of terrorism. Pakistan has been on the list since 2018 and has been forced to take a series of measures to comply with international guidelines. The political turmoil in Pakistan continues and at the end of the month, ousted opposition politician Imran Khan initiated a protest march with his supporters to the capital, Islamabad. The protests have so far been peaceful and the stock market did not react significantly during the month. Imran Khan’s call for early elections has so far been ignored. Scheduled elections must be held no later than autumn 2023.

Bangladesh continues to negotiate with the IMF regarding measures to activate a support package of USD 4.5 billion.

Vietnam has also been affected by the global situation and during the month raised the interest rate by 1% for the second time in just over a month. The country’s stock market has recently suffered from a crisis of confidence that has its origins in alleged irregularities in the real estate market. The chairman of one of the largest real estate companies was arrested and the traces led to one of the largest local banks, where the entire company management was replaced. The turmoil has since spread to other real estate companies and the banking sector in general. The real estate and banking sector jointly constitute around 55% of the broader Ho Chi Minh Index. We have stayed away from both sectors which have supported our performance during 2022. Overall, the events during 2022 are likely to lead to long-term improvements in Vietnam’s previously slightly overheated equity market, and it should be perceived as a long-term positive factor that the authorities show that they are prepared to curb irregularities when needed.

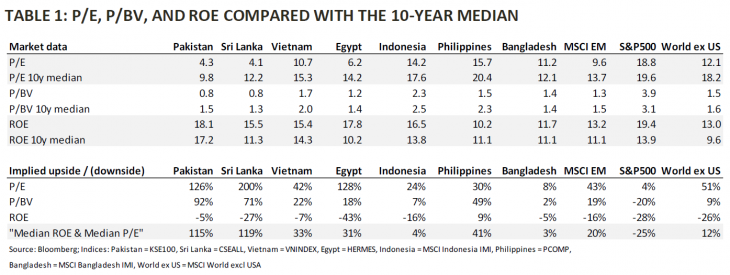

The recent events in Egypt and Vietnam are a reminder that the climate in our markets remains challenging and that it takes time to work through shocks like the ones we have seen in the past year. Even if we don’t see immediate improvements, it should be noted that for several months we have seen how commodity prices have started to descend as world growth slows down and transitions to concerns about recession. We note that inflation levels will begin to move downward from current levels in the coming six months. This will gradually improve the economic conditions in the majority of our markets, which today are valued at levels we have not seen in the last decade and, in several cases, as far back as there are reliable statistics. We are now at a stage where it is certainly difficult to identify triggers for an immediate reversal, but at the same time, it is equally difficult to imagine what else could hit our markets that have not already been discounted by jaded investors.

______________________________________________________________________

TUNDRA SUSTAINABLE FRONTIER FUND REPLACES THE SWAN WITH THE EU’S REGULATIONS FOR SUSTAINABILITY

In connection with the new EU regulation under the Sustainable Finance Disclosure Regulation (SFDR), new requirements are applied to funds’ sustainability work as of March 2021. Tundra has therefore decided on July 4 not to continue with the Nordic Ecolabelling of the fund. According to the new regulations, sustainability reporting must take place in a uniform manner and funds are divided into different categories. The Tundra Sustainable Frontier Fund is classified as an Article 8 fund (Light green: promotes environmental or social characteristics). The investment philosophy of the fund remains the same; management of the fund and is not affected by the change.

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you will be able to recover all of your investment. Historical return is no guarantee of future return. The Full Prospectus, KIID etc. are available on our homepage. You can also contact us to receive the documents free of charge. Please contact us if you require any further information: +46 8-5511 4570.