STRONG REPORTS SUPPORTED THE FUND

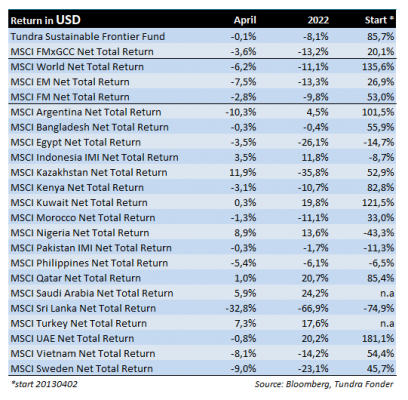

In USD the fund fell 0.1% in April (EUR: +5.4%), compared with MSCI FMxGCC net TR (USD) which fell 3.6% (EUR: +1.7%) and MSCI EM Net TR (USD) which fell 7.5% (EUR: -2.4%). Measured in USD and in absolute returns Indonesia (+0.8% absolute contribution to the portfolio; our sub-portfolio rose 8%), Kazakhstan (+0.6%; sub-portfolio rose 30%), and Egypt (+0.6%; sub-portfolio rose 9%) were the best contributors. The largest negative absolute contribution came from Sri Lanka (-1.4%; the sub-portfolio decreased by 24%).

On an individual company basis, the largest positive contribution came from Indonesian Hermina Hospitals, which rose 18% during the month (+0.8% absolute portfolio contribution) after announcing a private placement at a significant premium compared to the share price. The second-largest contribution came from Kazakh Kaspi (+30%; 0.6% portfolio contribution), which recovered in line with declining concerns about the imposition of sanctions on Kazakhstan. The third-largest contribution came from Egyptian GB Auto, which rose 14% (0.4% portfolio contribution), recovering after the somewhat odd correction last month. Our biggest negative contributions were mainly from Sri Lanka, primarily due to continued weaker currency (the Sri Lankan rupee lost another 16% in unrest following the country’s deplorable crisis management). Asiri Hospitals fell 22% (-0.4% contribution) and Windforce fell 20% (-0.3% portfolio contribution). The third-largest negative contributor was the Philippines’ grocery retailer Puregold, which fell 8% (-0.3% portfolio contribution).

During the month, Sri Lanka announced the anticipated restructuring of its foreign debt, a process that should take at least a couple of months, given how late the country has started its crisis management. However, it is a first step in the right direction. In the last two days of April, we saw a pretty solid recovery. However, this did not stop Sri Lanka from being the world’s worst stock market in April. Broad CSE All Index fell 14% in local currency but as much as 28% in USD.

In Pakistan, Prime Minister Imran Khan was voted out in the parliament, and the new prime minister is now Shehbaz Sharif from PML-N. Judging by the actions of the new coalition government, they seem to want to try serving out the term of office (2023). However, ousted Imran Khan’s PTI has gained a lot of popularity after the episode of April 9th and is now employing street power to call for an early election in the country. Hence, we expect a rather harsh political tone between the governing parties and PTI. The timing is not ideal. Pakistan needs consensus on an economic plan that will enable continued support from the IMF. Local newspapers reported in early May that Pakistan is discussing a support package from Saudi Arabia of USD 8 billion. If it materializes, it is a positive first step. We have been positive about the economic policies pursued by the former governing party PTI and hope that the better parts of this will continue under the new government. During the first days of May, the new government announced that they will not extend the term of Central Bank Governor Reza Baqir whose term ends in May. It is unfortunate as he has acted with great credibility during his time at the central bank.

Our visit to Egypt in March has resulted in us again being shareholders in Cairo for Investment & Real Estate Development (CIRA), which owns and operates schools (from pre-school to university). We were shareholders from the end of 2018 until March 2020, when we sold the holding after a very strong performance while we saw better potential in other holdings. Since then, the stock has corrected around 25% in local currency (40% in USD) while the company has doubled its revenue. CIRA continues its expansion, with more faculties and more students in existing facilities, while they are planning to build more universities. There is a significant shortage of higher education seats in Egypt, at the same time as the high population growth means there will be a sharp increase in young people of university age over the next 10 years. The company’s management has clearly shown its ability to execute its business strategy. CIRA is also an excellent example of a company that society benefits from as the company’s growth saves money for the state while Egypt’s human capital (the present value of all future salaries) increases with increasing education.

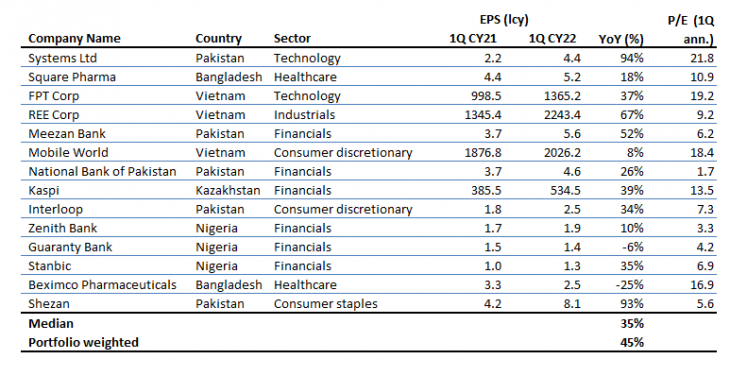

Fourteen of our portfolio companies (47% of the fund) reported their results for the first quarter (calendar year), and the earnings were generally strong. 12 out of 14 companies increased earnings compared with the corresponding quarter in 2021. The median increase in earnings per share was 35%. Portfolio weighted, the profit increase was as much as 45% which means our larger holdings did especially well. Pakistani IT company, Systems Ltd, almost doubled its profit in the first quarter. The company benefits from the weaker rupee while volume growth remains strong. Systems’ counterpart in Vietnam, FPT Holdings, increased profits by 37% during the first quarter while our second largest position Bangladeshi Square Pharmaceuticals delivered a second strong quarterly report with an increase in earnings per share of 18%. Another two of our ten largest positions, REE (Vietnam’s ambitious renewable energy producer) and Meezan Bank (the leading Islamic Pakistani bank) delivered excellent results with profit increases of 67% and 52% respectively on an annual basis during the first quarter. Looking at the portfolio as a whole, the first quarter historically accounts for less than 25% of the full-year profit, which gives increased relevance to the last column of Table 1 where we’ve calculated a P/E ratio based on the first quarter’s annualized figures (4 x 1Q-results).

Most of our markets have had a strong headwind since the rise in commodity prices began in the spring of 2021. This, in turn, followed years of crises, of which COVID-19 was only one. The fund has performed well, even though most of our markets had a tough period. Strong stock selection has compensated for sub-optimal market performance. As a result, we are today the only fund in Morningstar’s category “Frontier Markets” with the highest rating (5 stars) over both 3 years and 5 years. However, it is worth noting that the fund over 3 years and 5 years is now also one of the best funds globally in the Emerging Markets category as well. Among the funds registered on Morningstar in Sweden, we are currently among the top 5 (out of 240) and on the more accessible platforms for retail investors (Nordnet and Avanza), we were at the end of April the best-returning emerging market fund over both 3 years and 5 years. We are already the fund on the Swedish Pensions Agency’s platform (PPM) that has the highest return over 5 years in the category “New Markets”. We would like to thank all our unitholders for the trust you have all shown. We will do our best to maintain it. Even though both the world and our markets will work through serious concerns near term, we hope that there will then be a period where our alpha generation can be elevated by strong market returns as well.

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you will be able to recover all of your investment. Historical return is no guarantee of future return. The Full Prospectus, KIID etc. are available on our homepage. You can also contact us to receive the documents free of charge. Please contact us if you require any further information: +46 8-5511 4570.