THE FUND

The Fund fell 0.2% in April, compared to MSCI FMxGCC Net TR (SEK), which rose 0.9% and MSCI EM Net TR (SEK), which rose 4.6%. Positive contributions accrued from our underweight in Argentina (+1.5%). We also received positive contributions from Egypt and Nigeria (+0.3% each). Negative contributions accrued from our underweight in Morocco (-0.6%), Romania (-0.4%), Kenya (-0.3%), Bangladesh (-0.4%), and Pakistan (-0.3%). Further on, the Fund’s holdings in Sri Lanka (12% of assets) were only marginally affected by the terrifying terrorist attacks that occurred in Colombo April 21st, which says a lot about the market’s already low expectations. In April, we chose to completely exit our smaller position in Argentina (about 5% of the portfolio). The decision was taken in light of the fact that the valuations in other parts of the portfolio are more attractive.

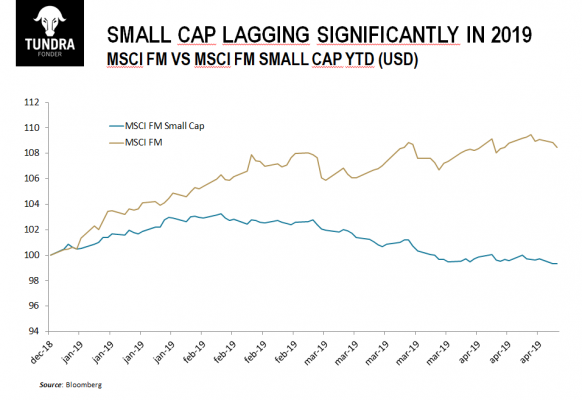

In 2019 year to date, we find ourselves in the unusual situation of lagging most of our peers in the “Frontier Markets”-category (7% below average peer). There are two main factors behind this. First and foremost, our lack of holdings in the Middle East. Kuwait and Bahrain are the two best stock markets this year, with gains of 26% and 40% respectively, which together has cost 7% relative to the broader MSCI frontier index and thereby many of the funds in our category. The Gulf countries have benefited from concerns in less developed markets as they are considered safer and less vulnerable to currency fluctuations. The Fund does not invest in the Gulf countries and we do not see this part of the world as the future in the next generation of emerging markets. The second factor of the weak performance in 2019 has been our relatively higher allocation to medium-sized and small companies (companies with market capitalization below USD 1 billion). In most stock markets around the world, small cap indices have over time outperformed the large cap indices, also in Frontier Markets. However, 2019 has been characterized by caution and continued concern about setbacks in global equity markets. The continued low risk appetite has meant that the FM small cap index has performed close to 10% worse than the broader FM index (see graph) during 2019. As history can tell, we believe this is a transient phenomenon and that we once again will be rewarded for our exposure outside the largest index companies. Tundra has a fundamental investment philosophy based on traditional DCF analysis (discounted cash flows). With the simplifying assumption that P/CF corresponds to P/E, i.e. that depreciation corresponds to new investments, we note that the portfolio’s current average valuation of P/E 7.4x for an indebted company implies slightly more than 18% WACC (the required return an investor wants to undertake an investment) and average growth of 4% over the next 30 years. There is also a theoretical anomaly given that the high WACC stems from nominally high interest rates, which in turn reflect high inflation expectations, higher than the 4% that growth expectations currently reside. In the last 5 years, the real GDP growth in our core markets has been just over 5% and we estimate that our portfolio companies will grow even more rapidly. With that being said, one can conclude that the market today builds its expectations on a scenario that seems theoretically challenging to realize, alternatively the market assumes that the companies in our portfolio on average will aggressively destroy capital through investments. Looking back historically at more normal market conditions, we note that a the WACC over a cycle in our markets tends to be between 13-15% and that a more realistic long-term growth assumption is 6-8%. This would in itself imply a more reasonable valuation of P/E 12-16x. After several years of major currency movements, it is natural that investors are cautious, even afraid given what is behind us and the short-term uncertainty created as a result of that. Risk aversion is a healthy attribute, but it has historically proved to be stronger after a period of weak market development than after a period of strong price development. How long current risk aversion persists cannot be determined, and every investor must make his/her own assessment of the risk of not catching the bottom. However, we can conclude that the preconditions for a longer period of returns above the historical average in the Fund have never been better.

MARKET

MSCI FMxGCC Net TR (SEK) rose 0.9% during the month, compared to MSCI EM Net TR (SEK), which rose 4.6%. The Swedish krona weakened 2.4% against the dollar and most of the underlying market currencies. The best markets during the month were Kazakhstan (+9%), Morocco (+6%) and Kenya (+5%). The worst markets were Argentina (-6%) and Sri Lanka (-2%).

On April 21st, Sri Lanka was hit by a number of coordinated terrorist attacks where 250 people lost their lives. At present, the official information is that a local terrorist organization, NTJ, carried out the attacks, possibly backed by ISIS, which afterwards claimed responsibility. The Sri Lankan tourism organization estimate that the loss of revenue over the next twelve months will be around USD 1.5 billion, about 30% of the estimated tourism revenue for 2018. Even though, the attacks occurred after the peak season, there is a risk of a significant fall in the number of arriving tourists. That being said, it should be added that this type of event should be seen as uncommon in Sri Lanka as it was in Paris, Marseille or Stockholm. There is no traditional breeding ground for religiously motivated terrorism in the country. The civil war that ended in 2009 had a completely different background. The recruitment base for terrorists tends to be found among the most vulnerable groups of a population with limited educational background, whereas several of the assaulters in this case were well-educated, some educated abroad. Sri Lanka is often used as an example of a country with great tolerance for different religions and although confrontations have arisen between mainly Buddhists and Muslims, one must conclude that the shock from the events is as significant as when it occurred in Sweden. The fall in tourism revenues will, in the short term, hit the current account. However, the current account has recently improved after the sharp currency depreciation and the numbers discussed should be manageable within the framework of customary borrowing, extra support packages and alike. Tourist arrivals is likely to fall sharply in the coming twelve months (from previously expected about 2.5 million for the full year). The extent of the drop and from where it can once again grow depends on Sri Lanka’s crisis management and how soon the country can restore confidence among international visitors.

The stock market has been in a steady downward trend during the current government. Internal wear and tear has created paralysis of action and both the business society and investors in the equity market have been requesting change. The equity market is now at the lowest levels since the end of 2009, calculated in USD. The Presidential elections is scheduled somewhere between the end of 2019 until the beginning of 2020 and the elections to parliament in 2020 (no earlier than March, no later than December). What occurred April 21st has, cynically enough, significantly increased the likelihood of former President Rajapaksa’s party coming back to power. Given the still very tough discussions between the opposition and the incumbent government after the attacks, we would not be surprised if the elections are brought forward. We think this would be very positive for the equity market. Further on, in May, changes in the MSCI Emerging Markets index will occur. From June 1, Argentina will be included in the MSCI Emerging Markets index. Given that Argentina accounts for almost 13% of the Frontier Markets index (third largest after Kuwait 26% and Vietnam 16%) and no new countries are added, the other countries’ share of the index will increase proportionately. It may also be worth noting that during the third week of June (around June 20th) we should get two more important statements. The first is whether Kuwait will be upgraded to the MSCI Emerging Markets index (if so, it will be included in MSCI EM June 1, 2020). Kuwait is in that case following the United Arab Emirates and Qatar which were included in the MSCI Emerging Markets in June 2014. We note that when we started our Fund in 2013, 2/3 of the index was constituted by the Gulf countries. If Kuwait is approved for inclusion, the Index will in about a year’s time will have less than 10% Gulf exposure and thus will be very close to the benchmark we have used since inception (MSCI FM excl GCC-countries). The second important announcement in June is whether Pakistan is being put on watchlist for possible downgrade to the Frontier Markets index. We believe that it is relatively likely that Pakistan will be put on watchlist as the market currently does not have three constituents that fulfil the requirement for emerging markets status. However, we believe that it is extremely unlikely that the country will eventually be downgraded, given that there is plenty of room for MSCI to apply temporary exemption rules and MSCI has a stated objective of not changing category for countries more than absolutely is needed. The irony of the discussion about a possible downgrade of Pakistan is that it would probably be very positive for the Market. In the MSCI FM index, Pakistan would be one of the largest countries and one of the three most liquid Equity Markets. Its significance would make it too big to ignore. In Emerging Markets, the country continues to carry an anonymous existence with an index weight of less than 0.1%.

ESG ENGAGEMENT

In total, four companies were divested in April due to financial considerations. These include three Argentinian financial companies, BBVA Banco Francés S.A., Grupo Financiero Galicia S.A. and Grupo Supervielle; and Commercial International Bank S. A. E., an Egyptian bank. No new company was added to the Fund this month.

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you will be able to recover all of your investment. Historical return is no guarantee of future return. The Full Prospectus, KIID etc. are available on our homepage. You can also contact us to receive the documents free of charge. Please contact us if you require any further information: +46 8-5511 4570.