A MONTH OF CONSOLIDATION

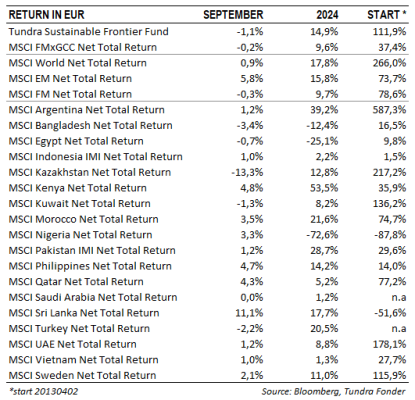

In USD, the fund fell 0.2% (EUR: -1.1%) during September compared to the MSCI FMxGCC Net TR (USD), which rose 0.7% (EUR: -0.2%), and the MSCI EM Net TR (USD), which rose 6.7%. In absolute return, it was primarily Indonesia (+0.6% portfolio contribution) and the Philippines (+0.5% portfolio contribution) that contributed positively, while Kazakhstan (-0.7% portfolio contribution) and Vietnam (-0.3% portfolio contribution) reduced the absolute return. Relative to our benchmark, it was primarily our underweight in Kazakhstan (+0.6% relative contribution), Indonesia (+0.6% relative contribution), and the Philippines (+0.6% relative contribution) which contributed to the relative return versus the benchmark during the month, while our stock selection in Vietnam (-0.8% relative contribution), underweight and stock selection in Morocco (-0.6% relative contribution), and lack of holdings in Iceland (-0.5% relative contribution) contributed most negatively.

The biggest single contribution came from Indonesian hospital company Hermina Hospitals (4% of the portfolio), which rose 20% after positive regulatory news, and one of the major local brokerages upgraded its estimates and issued a buy recommendation. The second largest contribution was received from the Philippine grocery chain Puregold (3% of the fund). The stock rose 14% on continued optimism about improved private consumption in the Philippines after the country started cutting interest rates again. The largest negative contribution was received from the Kazakh fintech company Kaspi (3% of the fund), which fell 19% during the month after a short-selling report which, among other things, claimed that the company received illegal Russian money. The stock initially fell close to 30%, but later recovered after the report was dissected and the company responded to the information. In our view, the report is deliberately misleading with the aim of scaring down the share price. Even if Kaspi’s deposit inflow only to a limited extent come from Russian citizens or former Russian citizens, this is of course not illegal as long as these are not sanctioned. Analysts’ accusations that Kaspi’s chairman Vyacheslav Kim’s daughter would have improperly benefited from ownership in a related company became almost laughable when it turned out they did not read the Cyrillic alphabet correctly. The person, who had a different name, turned out to be unrelated to Kim. The fact that there is a 16-year age difference between Kim and the designated “daughter” should, if nothing else, have prompted a fact check of the information before publication. In addition to this, the analysts highlighted certainly not flattering, but nevertheless well-known, historical connections to the former presidential family. However, this is information that has emerged from the information provided by the company at the time of the stock market listing and which, in our eyes, has always motivated a higher risk premium (before the correction Kaspi traded at 10x this year’s earnings, vs for example Mercado Libre which trades at 50x). The stock recovered towards the end of the month, but still closed 19% down for the month. It’s a reminder of social media’s ability to quickly spread misinformation that takes all the longer to wash away. It also raises questions about where the line is drawn for this type of action to be considered criminal.

KEY MARKET EVENTS

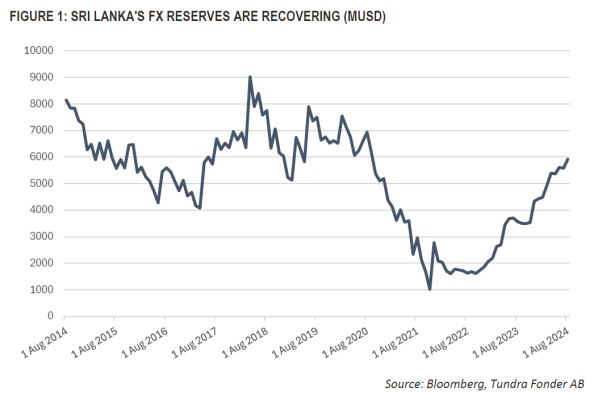

In Sri Lanka, the left-wing candidate Dissanayake won the election. After immediately striking a conciliatory tone, with promises to continue stabilizing the country and support business, the stock market rallied and ended up the month’s winner in frontier markets with a 12% gain. Quite immediately, Dissanayake dissolved parliament and called for parliamentary elections to be held on November 14. After the rise, the Sri Lankan equity market is back to the levels of the late spring. The focus from here on will be on the parliamentary election. The expectation now is that Dissanayake’s party NPP will win a single majority, something that would simplify decision-making going forward. Given the relatively less well-developed organization of the party, compared to the more well-established parties, there is a certain risk that this will not be the case and that you end up in a situation where you must rely on support from one or more of the other parties. In the end, however, the most important thing for Sri Lanka right now is continued stabilization and this is continuing. The strong recovery for the tourism industry, combined with increased remittances from Sri Lankans living abroad, means that the central bank has been able to build up its reserves again, something that looks set to continue for some time going forward. The equity market is currently trading around 1 standard deviation below its ten-year average, both measured in P/E and P/BV, and should be able to continue to recover.

During the month, Bangladesh received positive feedback from its discussions with the IMF regarding an increase in its loan by USD 3 billion. In addition, the country claims to have approached an agreement on additional loans of USD 5 billion with other multilateral organizations. It thus looks like the country’s political changes, as expected, will be supported by the international community. We also note that remittances during September amounted to USD 2.4 billion, an increase of 8% compared to August and an increase of 80% year-on-year. The increase comes against the background that the official exchange rate now corresponds to the level that can be obtained on the black market, which increases the flow of capital in the official banking system. During the month, as expected, the central bank raised the policy rate by another 50 basis points, to 9.5%. A further increase of 50 points in October is expected. Bangladesh was the last of our larger markets to enter the crisis, but given the credible way the situation is now being handled, we expect to emerge on the other side within 12–18 months.

In Pakistan, the IMF this month approved a 37-month Extended Fund Facility (EFF) of USD 7bn following the country’s completion of the program’s pre-conditions. According to media reports, Pakistan has secured a three-year debt rollover from bilateral creditors—China, Saudi Arabia, and the United Arab Emirates—rather than the previous annual rollovers. This arrangement will help insulate financial markets from debt rollover risks in the medium term. The central bank surprised the market with an unexpectedly large reduction in the policy rate, 200 basis points to 17.5%. As inflation for September came in at 6.9%, the real interest rate is still above 10%, and further reductions may occur before the end of the year.

OBSERVATIONS FROM OUR RECENT TRIP TO PAKISTAN

We recently returned from a week’s trip to Pakistan, where we engaged with over 25 corporates. Overall, there’s a shared sense of optimism among businesses, with expectations for inflation and currency stability, as well as a projected decline in interest rates to the low teens by 2025. Notably, we observed a strategic shift among companies, focusing more on localization and import substitution, as well as exports, compared to five years ago.

Some corporations are even opening physical stores or depots in rural areas to provide agricultural products and services to farmers, tapping into the USD 90 billion opportunities in Pakistan’s agriculture sector. However, many businesses expressed concerns about the lack of government reforms leading to soaring electricity prices, which have pushed numerous industries and households toward renewable energy sources. This trend has contributed to a decrease in overall grid electricity consumption, further driving up costs for grid power and encouraging off-grid solutions. So far, in 1H 2024, solar panels with a total capacity of 10,450 MW have been imported in the country. This can be compared to Pakistan’s total capacity installed, which is 45,885 MW. It bodes well for the long-term energy imports balance which historically has been the main culprit for Pakistan’s recurring crises.

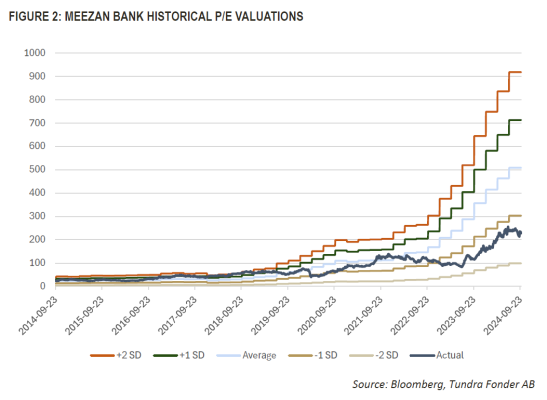

Banks anticipate a return to more normal conditions, although they expect contractions in net interest margins (NIMs) and return on equity (ROE) due to falling policy rates. This impact will be particularly significant for Islamic banks, which have benefitted most from the high-interest environment, unlike conventional banks that are subject to a minimum deposit rate (MDR). The fund’s second largest banking position, Meezan Bank, will be significantly impacted of course. But given the current valuation of 4x earnings, vs a 10-year average of 8.7x this appears to be well priced in however as can be seen from Figure 2. Even a normalization of the bank’s ROE to 30%, from current 50% would imply it trades at less than 7x earnings, whereas we expect the bank to continue to grow above the sector average in terms of deposits and loans and now in an improving environment for equities. All the banks we spoke with voiced concerns about additional tax burdens linked to unmet Advances to Deposit Ratios (ADR) targets and the government’s liquidity surplus, which has led to interbank lending rates falling below the policy rate for the first time in a decade. Nonetheless, many banks are hopeful for a rise in credit demand and an improvement in non-performing loans (NPLs) in the coming year.

In our discussions with pharmaceutical companies, we noted a more confident outlook this time around. Historically cautious about drug pricing policies, these companies are now optimistic, particularly since the government has deregulated prices for non-essential medicines. This allows them to increase prices freely and launch new products that were previously unfeasible.

In the manufacturing sector, we observed a strategic pivot toward localization, import substitution, and exports. Pakistan has traditionally imported more than it exports, resulting in a significant trade deficit, which is bridged with foreign borrowings. Many capital and consumer goods manufacturers pointed out recent years’ challenges with foreign exchange sourcing, prompting them to acknowledge the necessity of reducing reliance on imports and increasing their dependence on export revenues. They believe that Pakistan’s low labour costs (around USD 120 per month) compared to neighbouring countries, along with high import duties on Chinese products, make non-textile exports increasingly viable, especially in sectors where labour costs are significant. A good example is mobile phones where in the last couple of years Pakistan has moved to more than 90% locally assembled products, from previously being almost completely dependent on imports. We met with one of the largest local assemblers and were impressed with what we saw.

We like the sentiment we’re seeing. People on the ground are still catching their breath after a couple of terrible years. We also note a lingering disenchantment post the removal of Imran Khan in 2022, and the military stepping out from the shadows as the official decision-maker. The positive side effects (stability) took almost two years, and many locals described a situation of hopelessness during this time. The optimism we are now seeing is thus still in its early phase, where wounds are yet to be healed. Our impression is that locals have been surprised by the aggressive rate cuts by the SBP. In Autumn 2023, we described a scenario in which, based on historical patterns, we could see rate cuts of 450-500 bps cut in 2024, but most local investors have taken a wait-and-see approach. Since the first cut in April the SBP has now cut rates by 450 bps to 17.50%, and with the recent inflation number (6.9%), stable current account balance and stronger currency, there could be more to come already this year.

We also like that the equity market exposure among local investors is very low. Pension funds and other long-term investors are still on the lower side of their equity exposure. We met with the largest private asset manager (Meezan), where equity funds currently make up around 10% of assets, in their case decided by investors’ preferences. As investors are no longer enjoying +20% interest in the treasury market, and the equity market starts performing, we could see a swing back to equities. And these tend to be significant.

Potential black swans that could impact a positive scenario remain politics, specifically the situation for Imran Khan who continues to enjoy strong support. While in Pakistan we noted protests primarily in Islamabad and the northwestern parts of Pakistan which led to roadblocks, and disruption in traffic. As opposed to the situation in Bangladesh a revolution in Pakistan would however require the population to take on the military which is possibly the most respected and feared institution in the country. At some point, the military and Imran Khan will need to find a compromise. The probability that this would include the military letting go of the grip it has had on the country since 1947 must however be considered to be extremely low.

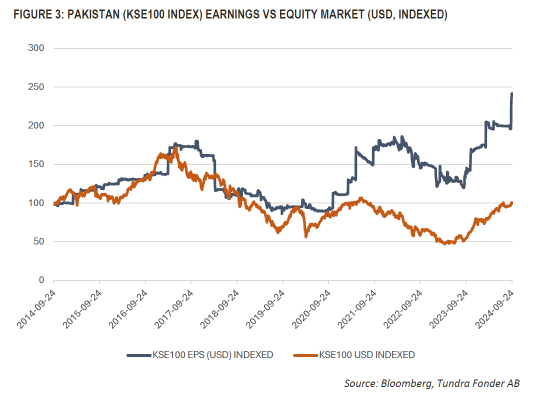

Our case for Pakistan has never been about the potential of massive reforms and a resulting revaluation to levels seen in other emerging and frontier markets, but simply the resilience of corporates who in our view trade at a too steep discount versus their historical growth. What Pakistan primarily needs right now is stability, allowing corporates to focus on business, and investors to focus on what corporates deliver. Post the pain of the devaluation and the resulting stabilization of the current account, this stability appears to be here. This should allow the equity market’s valuations to revert to normal levels, from the current 5.1x to the 10-year average of 8.3x. Given what we’re seeing on the current account side, with increased use of renewable energy and indigenous coal for electricity generation substituting some of the energy imports, increasing localization following the last couple of years of harsh import restrictions, and credible signs of increasing exports, there could be arguments as to why Pakistan might have addressed some structural deficiencies. For now, however, we focus on the next 2-3 years which look promising regardless. As can be seen from Figure 3, the gap between earnings and equity market performance remains significant versus history, indicating a continued very high-risk premium. This gives a good cushion in case of disappointments and indicates a significant upside in case of no negative surprises.

___________________________________

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you be able to recover all of your investment. Historical return is no guarantee of future return. The state of the origin of the Fund is Sweden. This document may only be distributed in or from Switzerland to qualified investors within the meaning of Art. 10 Para. 3,3bis and 3ter CISA. The representative in Switzerland is OpenFunds Investment Services AG, Seefeldstrasse 35, 8008 Zurich, whilst the Paying Agent is Società Bancaria Ticinese SA, Piazza Collegiata 3, 6501 Bellinzona, Switzerland. The Basic documents of the fund as well as the annual report may be obtained free of charge at the registered office of the Swiss Representative.