GLOBAL CONCERNS WEIGHED ON MARKETS DURING SEPTEMBER

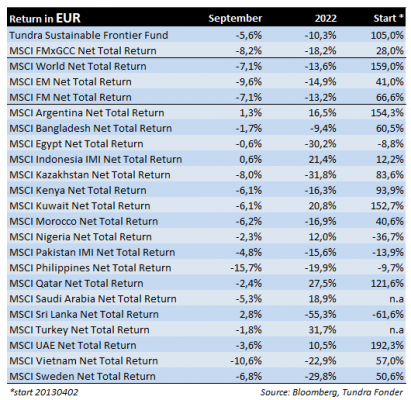

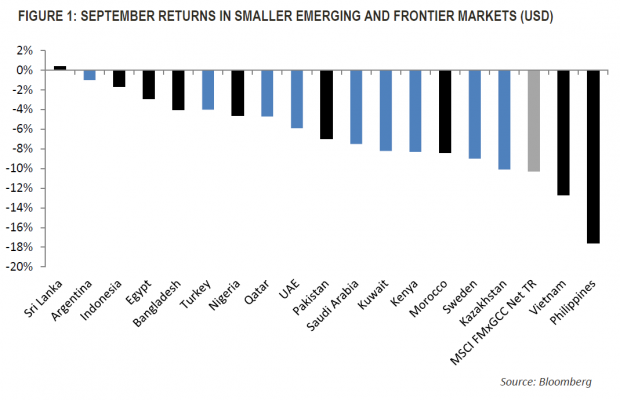

In USD the fund fell 7.8% (EUR: -5.6%), compared to MSCI FMxGCC Net TR (USD) which fell 10.3% (EUR: -8.2%) and MSCI EM Net TR (USD) which fell 11.7% (EUR: -9.6%). As can be seen from Figure 1 (black colored bars are countries where Tundra has invested), the majority of our markets fell during the month.

In Sri Lanka, the stock market rose marginally and our sub-portfolio gained 5%. The country has now started negotiations with its creditors. Best-case IMF board approval can be attained before year end.

Positive contributions were also received from Egypt and Morocco. In Egypt, it was primarily our position in the education company CIRA (3% of the portfolio) that performed well. The company operates private universities, schools and kindergartens in Egypt. The stock rose 9% (USD) in the month after its most recent expansion, Badr University Assuit, now open for admissions. In Morocco, our only position, the IT company Hightech Payment, rose 4% (USD) in a falling market. The rise came in the wake of a strong half-yearly report.

The largest positive contribution in the portfolio was received from the Indonesian hospital chain Hermina Hospitals. The stock rose 6% during the month after Astra International (which already owns more than 5% of the company) bought additional shares. Although a small position, Sri Lankan grocery chain, Cargills Ceylon, rose just over 20% during the month adding to the positive relative performance. In the company’s half-year report, we note that despite the Sri Lankan rupee being devalued by roughly 40% against the US dollar, the company managed to increase its turnover – calculated in US dollars. The company has invested a lot in supporting local production of raw materials over the years and a large part of the products that are sold come from the company’s own factories. Those investments are likely factors behind the company’s resilient performance.

The negative contributions outweighed the positive during September. The biggest negative contributions came from Vietnam, where all four of our holdings fell during the month. One of our largest holdings, Vietnamese REE Corp, whose main growth area is its renewable energy business, fell 12% during the month and was the single largest negative contributor. The Philippine grocery chain, Puregold, was also among the losers with a 21% (in USD) decline in a weak Philippine market (-18% in USD in September). During the month, Bangladesh also devalued its currency or, as the central bank put it, moved to a floating exchange rate regime. The currency weakened by 6% against the USD. Since the turn of the year, the Bangladeshi Taka has weakened 15% against the US dollar, which does not stand out from a global perspective.

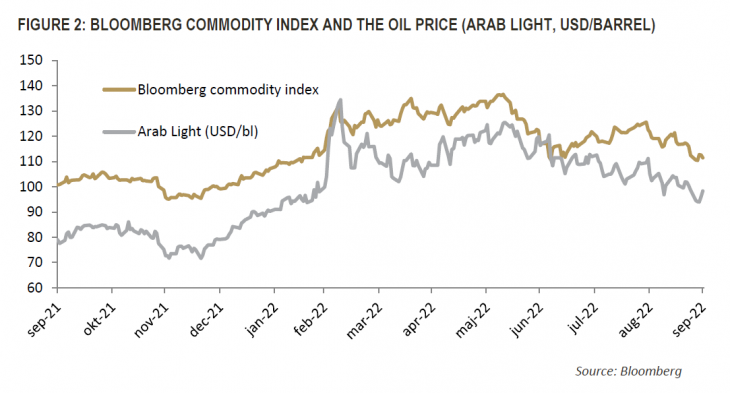

It was a turbulent month for most global equity markets as renewed inflation concerns and heightened expectations of further interest rate hikes dampened investors’ spirits. The US 10-year bond yield rose 70 bps to 3.82%. The fact that the longer maturities rose more (the 2-year yield rose “only” 30 bps) indicates that the market right now believes that inflation will remain at a higher level for a longer time than previously expected, which is generally negative for equities. However, recent sharp interest rate increases in Europe and the US also mean that the risk of recession is increasing, which has meant falling commodity prices (see Figure 2).

Falling raw material prices are positive for the majority of our countries, given that they are net importers of raw materials and will see a positive effect on both current account balances and inflation going forward. Given that the economic growth in our markets is not very dependent on global growth, a global recession could be favourable for the majority of our markets, with the dampening impact it is likely to have on commodity prices.

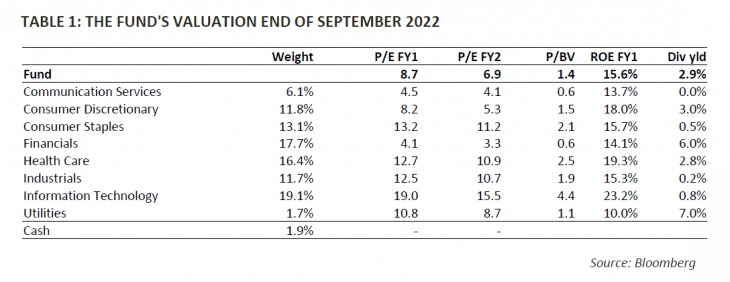

The fund’s valuation for the current year’s earnings is currently 8.7x, which is expected to drop to below 6.9x next year, implying 26% EPS growth. We understand the concern about long-term inflation, the potential impact on interest rates, and thereby equities. The best (and most straight forward) long-term inflation protection is however probably shares in fundamentally strong companies.

______________________________________________________________________

TUNDRA SUSTAINABLE FRONTIER FUND REPLACES THE SWAN WITH THE EU’S REGULATIONS FOR SUSTAINABILITY

In connection with the new EU regulation under the Sustainable Finance Disclosure Regulation (SFDR), new requirements are applied to funds’ sustainability work as of March 2021. Tundra has therefore decided on July 4 not to continue with the Nordic Ecolabelling of the fund. According to the new regulations, sustainability reporting must take place in a uniform manner and funds are divided into different categories. The Tundra Sustainable Frontier Fund is classified as an Article 8 fund (Light green: promotes environmental or social characteristics). The investment philosophy of the fund remains the same; management of the fund and is not affected by the change.

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you be able to recover all of your investment. Historical return is no guarantee of future return. The state of the origin of the Fund is Sweden. This document may only be distributed in or from Switzerland to qualified investors within the meaning of Art. 10 Para. 3,3bis and 3ter CISA. The representative in Switzerland is OpenFunds Investment Services AG, Seefeldstrasse 35, 8008 Zurich, whilst the Paying Agent is Società Bancaria Ticinese SA, Piazza Collegiata 3, 6501 Bellinzona, Switzerland. The Basic documents of the fund as well as the annual report may be obtained free of charge at the registered office of the Swiss Representative.