ANOTHER MONTH OF CONSOLIDATION

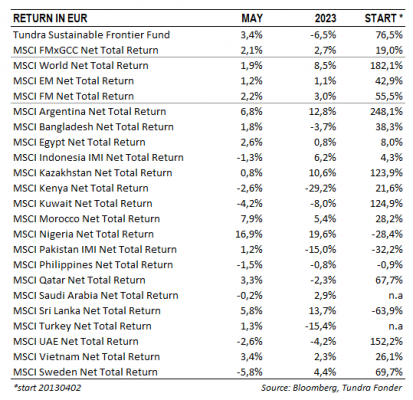

In USD the fund rose 0.5% (EUR: +3.4%) during the month, compared to MSCI FMxGCC Net TR (USD), which fell 0.8% (EUR: +2.1%), and MSCI EM Net TR (USD)which fell 1.7% (EUR: +1.2%). In absolute terms, the largest positive contributions came from Vietnam (+1.2%), Nigeria (+1.1%) and Sri Lanka (+0.7%), while Pakistan (-1.3%), the Philippines (-0.9%), and Morocco (-0.4%) were the three largest negative contributors.

Among individual holdings, the largest positive contribution was received from the portfolio’s largest holding, the Vietnamese IT company FPT Corp. In local currency, the stock rose 8.5%, compared to the market’s 2.5%. During the month, one of the world’s largest investment banks, JP Morgan, initiated coverage on the company with a buy recommendation. In the analysis, the company’s cost advantages compared to global competitors (lower wages), the supporting educational operations (100,000 full-time-students compared to roughly 20,000 five years ago) and the lower multiples compared to global competitors in India and Latin America were recognized.

More unexpected winners during the month were our Nigerian banks. Nigeria has been basically uninvestable for several years now. Natural advantages of large oil resources have been neglected through reluctance to reform, where fuel subsidies and capital controls have destroyed the investment climate. The newly elected president, Bola Tinubu, ran on promises to address Nigeria’s problem areas but investors have heard this before. However, during his inauguration speech on May 29, Tinubu announced that fuel subsidies would be eliminated, which then was implemented the following day. The price was raised overnight from about USD 0.40/litre to USD 1.2/litre. Nigeria’s total fuel subsidies currently amount to approximately USD 10 billion per year. To put this in context, it is equivalent to just under 30% of the country’s budget expenditure in 2022. There is a risk of protests and of courseTinubu being forced to withdraw the decision, like then president Goodluck Jonathan was in 2012. Something that speaks for the decision not being reversed is that Africa’s richest man, Aliko Dangote, inaugurated the world’s largest refinery in Nigeria in the weeks before the announcement. The capacity of Dangote’s refinery (650,000 barrels/day) will use a large part of Nigeria’s current oil production of approx. 1.3m barrels/day. The investment cost amounted to USD 19 billion. Mr. Dangote is unlikely to be interested in selling his products at a loss, which suggests that the decision will be firm. The market is now waiting for Nigeria to also allow a functioning currency market. If this also happens, the country can return to investors’ radar again after being considered a no-go zone for several years.

Our largest Pakistani holding, IT company Systems Ltd, fell 10% in local currency during the month and was the portfolio’s single worst contributor. Unfortunately, the current government continues to embarrass itself in the political arena in its attempt not to be completely wiped out at the planned elections this fall. During the month, the opposition leader of the largest party, Imran Khan, was arrested. This led to widespread protests and vandalism, including of military buildings. This in turn gave the government a reason to arrest a large number of PTI politicians and force them to leave the party. The government’s disastrous economic policies since taking office in April 2022 mean that their popular support is minimal now. Even if they succeed in splitting the opposition and removing Imran Khan from the election race the voices for change will remain. The country needs to call general elections to move forward. During the summer, we should receive an announcement about the election. The stock market is currently valued at 4x rolling twelve-month earnings and 3.3x 2023 expected earnings (KSE100 index), with a 10% dividend yield. Pakistan has always been an apparently cheap stock market, but the average for the last ten years is around 9x annual earnings and the last 5 years around 7x annual earnings. Current expectations say a lot about what the stock market thinks of how the country has been managed in the past year and has discounted a scenario significantly worse than what Sri Lanka went through, but until a political path forward is determined the stock market will not be reassessed.

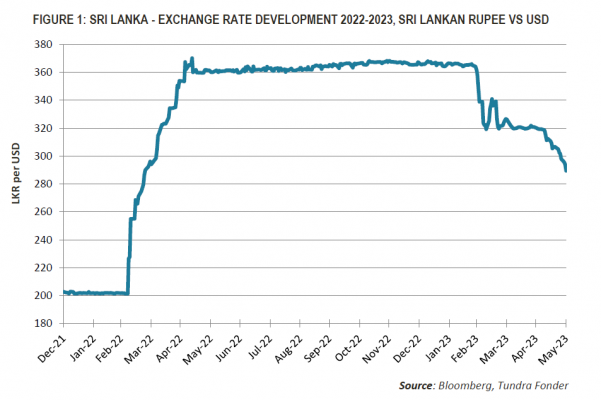

In Sri Lanka, the tone was more cheerful. Our holdings in Cargills and Sampath Bank rose 6% and 5%, respectively, in local currency during the month. With the currency strengthening a further 10% against the USD, both stocks ended up on the month’s winners list. After the country’s painful financial crisis in 2022, which saw the currency lose 45% of its value against the US dollar, the GDP fell 9% and it was forced to suspend payments on its foreign debt, it has managed to stabilize the situation through necessary economic decisions. Among the steps taken, the abolition of fuel subsidies and raising taxes are worth noting. A new agreement with the IMF is signed although the country is yet to agree on terms of its planned debt restructuring. During the month, the central bank unexpectedly lowered the interest rate by 250 basis points, from 16.0% to 13.5%. The central bank refers to the decelerating inflation, where it is now expected that inflation can fall to single-digit levels already during the third quarter (the previous estimate was the end of year). The unexpectedly sharp strengthening of the currency (20% from the bottom) is also likely to have played a role, as has the continued recovery in the tourism industry which is improving the current account.

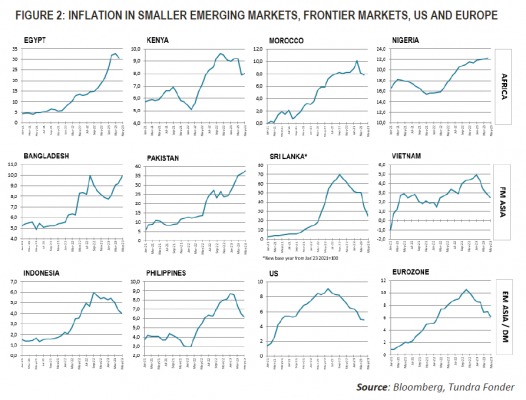

As we mentioned earlier, we have expected a gradual improvement in our countries’ economies during the second half of the year, where, above all, declining inflation provides the conditions for a less restrictive monetary policy and local capital can begin to return to the stock market. As can be seen from the image below, however, our countries are in different phases where the majority have already seen a change in trend, while it is still too early to say this in Pakistan, Nigeria and Egypt.

The fact that we have probably passed the biggest challenges suggests that investors in the second half of the year can start looking ahead again. The problems our most vulnerable countries are going through have resulted in record-low valuations. Although it will take time to work through the current challenges and there are risks of setbacks, the investment climate should gradually improve from here. To quote Arjun Divecha: “You make the most money when things go from truly awful to merely bad”.

______________________________________________________________________

TUNDRA SUSTAINABLE FRONTIER FUND REPLACES THE SWAN WITH THE EU’S REGULATIONS FOR SUSTAINABILITY

In connection with the new EU regulation under the Sustainable Finance Disclosure Regulation (SFDR), new requirements are applied to funds’ sustainability work as of March 2021. Tundra has therefore decided on July 4 not to continue with the Nordic Ecolabelling of the fund. According to the new regulations, sustainability reporting must take place in a uniform manner and funds are divided into different categories. The Tundra Sustainable Frontier Fund is classified as an Article 8 fund (Light green: promotes environmental or social characteristics). The investment philosophy of the fund remains the same; management of the fund and is not affected by the change.

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you be able to recover all of your investment. Historical return is no guarantee of future return. The state of the origin of the Fund is Sweden. This document may only be distributed in or from Switzerland to qualified investors within the meaning of Art. 10 Para. 3,3bis and 3ter CISA. The representative in Switzerland is OpenFunds Investment Services AG, Seefeldstrasse 35, 8008 Zurich, whilst the Paying Agent is Società Bancaria Ticinese SA, Piazza Collegiata 3, 6501 Bellinzona, Switzerland. The Basic documents of the fund as well as the annual report may be obtained free of charge at the registered office of the Swiss Representative.