POSITIVE MONTH IN WHICH PAKISTAN AND VIETNAM LED THE WAY

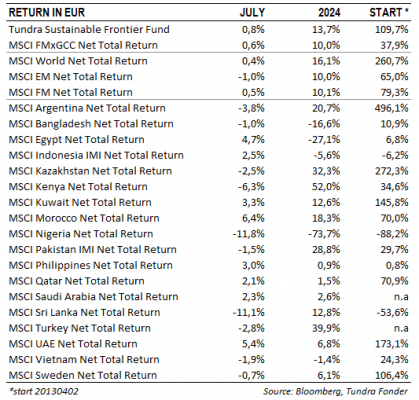

In USD, the fund rose 2.1% during the month of July (EUR: +0.8%) compared to the MSCI FMxGCC Net TR (USD), which rose 2.0% (EUR: +0.6%), and the MSCI EM Net TR (USD), which rose 0.3% (EUR: -1.0%). In absolute return, it was primarily Pakistan (+0.9% portfolio contribution) and Vietnam (+0.6% portfolio contribution) that contributed positively, while Nigeria (-0.2% portfolio contribution) was the only market to drag down absolute return. Relative to the index, it was primarily Vietnam (+1.0% portfolio contribution relative to the index), Pakistan (+0.9% portfolio contribution relative to the index), and the Philippines (+0.6% portfolio contribution relative to the index) that primarily contributed to the relative return during the month, while underweights in Morocco (-0.9% portfolio contribution relative to the index), lack of holdings in Romania (-0.5% portfolio contribution relative to the index), as well as Slovenia (-0.5% portfolio contribution relative to the index) contributed most negatively.

The biggest single contribution came from the company’s second-largest position, Vietnamese REE Corp (8% of the portfolio), which rose 12%. The rise came after one of the larger owners announced an offer to increase its ownership in the company at a premium to the share price. The second largest contribution was received from the National Bank of Pakistan (4% of the fund). The stock rose 27% following a number of more positive research reports, as well as strong performance for the smaller banks in Pakistan. The third largest contribution came from Philippine food producer Century Pacific (4% of the fund), which rose 9% without specific news. The largest negative contribution was received from the airport operator Airports Corporation of Vietnam (4% of the fund), which fell 4% during the month after a period of strong price development. The second largest negative contribution came from the Egyptian fintech conglomerate GB Corp (4% of the fund), which fell 3% after a strong performance during June.

KEY PORTFOLIO MOVES

During the month, Sri Lanka finally presented an agreement with international bondholders. The agreement must now also be approved by the IMF in order to be subsequently implemented. Ahead of the presidential election scheduled for September 21st), a new opinion poll was also published that shows more liberal candidate Premadasa is now leading the opinion polls (43% of the votes) and has thus passed the leftist candidate Dissanayke (30%). In third place is incumbent President Wickremasinghe (20%). Although we expect that all candidates intend to honor the agreement with the IMF, the economic policies of Premadasa and Wickremasinghe are seen as more predictable than Dissanyake’s. Thus, we see the poll as marginally positive for the equity market.

As expected, Pakistan reached a new agreement with the IMF on a new program totaling USD 7 billion. Although the program comes with some tax increases, it was received positively by the market as it signals further steps towards stability. Pakistan also cut interest rates by another 100 basis points, following last month’s cut of 150 basis points. There is still a good margin compared to inflation, which landed at 11.1% in July, and the central bank’s inflation expectations of 11.5%-13.5% until June 2025.

The most dramatic development took place in Bangladesh, where dissatisfaction with a new quota system for government employees led to demonstrations that later turned violent. Several hundred people are estimated to have lost their lives. At the beginning of August, Prime Minister Sheikh Hasina, who had been in power since 2008, resigned. In a statement from the army chief on August 5th, an interim government will be appointed, and new elections will be held. The changes come at a sensitive time for Bangladesh, as the country is under an IMF program.

The fact that the unrest appears to have ended so quickly, and with a definitive plan of action, should calm the situation on the ground so that the country can look forward again and more serious disruptions to the country’s economy can be avoided. From our communication with locals on the ground we note significant optimism. Flares of political unrest is common in our markets but it is extremely rare that they lead to political change. When they lead to political change it normally happens after significant pain and uncertainty, even if the eventual outcome is positive. Based on our initial impressions the situation in Bangladesh could be one of those rare cases where a dramatic shift can be undertaken without the traditional initial period of uncertainty and, based on statements from various local and international stakeholders, with significant consensus. We still await the interim government, and things can still go wrong in the political transformation. Further, the new setup will have to manage Bangladesh’s still fragile economic situation. But consumer sentiment and hope are important factors behind countries’, and equity markets’, drive forward. They might just have turned in Bangladesh’s favor.

Towards the end of the month and the first days into August, we noted significant turbulence on the world’s stock exchanges. Concerns that the US economy will slow down faster than expected, combined with increasing skepticism towards some of the high-flying valuations in the technology sector meant sharp price corrections. These have since spread to emerging markets, with the natural link being the technology sectors of South Korea and Taiwan. The decline of these markets can then, in turn, have contagion effects on other major emerging markets where foreigners are significant shareholders. The depth of the decline and how long it lasts will determine the impact on frontier markets and smaller growth markets. The best market climate for our markets is dull to mildly declining global equity markets. This stimulates investors to look around for other investment opportunities. Sudden and sharp price falls on global stock markets usually have a certain negative effect on our markets, although the effect should be less given the relatively weaker performance in recent years.

___________________________________

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you be able to recover all of your investment. Historical return is no guarantee of future return. The state of the origin of the Fund is Sweden. This document may only be distributed in or from Switzerland to qualified investors within the meaning of Art. 10 Para. 3,3bis and 3ter CISA. The representative in Switzerland is OpenFunds Investment Services AG, Seefeldstrasse 35, 8008 Zurich, whilst the Paying Agent is Società Bancaria Ticinese SA, Piazza Collegiata 3, 6501 Bellinzona, Switzerland. The Basic documents of the fund as well as the annual report may be obtained free of charge at the registered office of the Swiss Representative.