A MONTH OF CONSOLIDATION

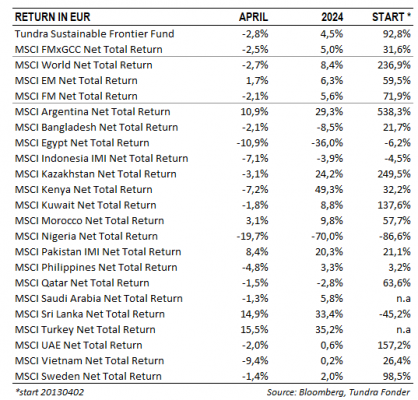

In USD, the fund fell 3.8% (EUR: -2.8%) during the month compared to MSCI FMxGCC Net TR (USD), which fell 3.5% (EUR: -2.6%), and MSCI EM Net TR (USD), which rose 0.7% (EUR: +1.7%). In absolute return, it was primarily Pakistan (+0.4% portfolio contribution) and Sri Lanka (+0.3% portfolio contribution) that contributed positively, while it was mainly Egypt (-1.4% portfolio contribution) and the Philippines (-0.8% portfolio contribution) which reduced the absolute return. Relative to our benchmark, it was primarily Vietnam that saved the relative return in April. Our sub-portfolio fell only 2%, compared to the market which fell 10% during the month.

Among individual holdings, Vietnamese FPT (8% of the portfolio) was the single most important contribution. The stock rose 3% despite the weak local market. The company’s results for the first quarter confirmed a continued strong development, with profits up 20% and revenues up 21%. However, the primary movement in the stock came after the company presented a cooperation agreement with American Nvidia where FPT will build an “AI factory” to develop its service offering. The agreement also covers the introduction of courses at the universities FPT operates in its educational activities. Indonesia’s Hermina Hospitals (3% of the portfolio) rose 6% during the month after delivering a surprisingly strong report, following a period of weaker performance. In the first quarter, profit rose 75% and revenue 26% compared to the first quarter of 2023. Our Egyptian companies, GB Corp, Juhayna, and CIRA all fell between 11-22%. The Egyptian market fell 12% during the month after a strong rally in the wake of the devaluation in March. Our Philippine holding Puregold fell 14% during the month after margins in the company’s first-quarter report came in below expectations. There has been a large establishment of discount stores in the last year. In order to meet the competition, the company has selectively lowered prices on the parts of the range that directly compete.

IMPRESSIONS FROM OUR TRIP TO THE PHILIPPINES

During the month, we visited the Philippines, where we met our portfolio companies but also other leading players.

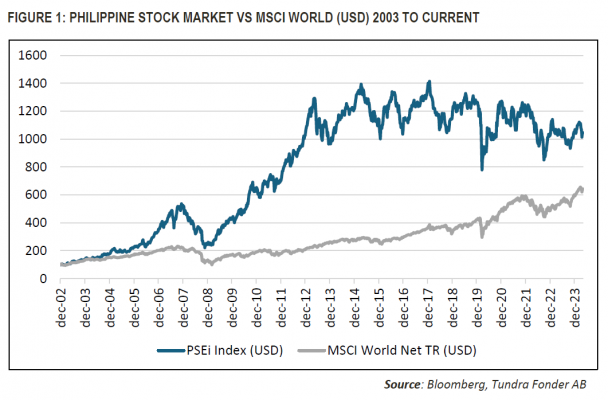

After a few years of adjustment after the Asian crisis of 1997-98, the Philippine stock market delivered an average annual return of 18% (in USD) between the period 2003-2017. In the last 6 years, the stock market has however been disappointing with a decline of just over 20% in USD.

The country was hit hard by COVID-19 and the rise in commodity prices that began in the spring of 2021. A large part of the food consumed is imported. Food already made up a high proportion of disposable income for the average consumer, and the price increases from spring 2021 thus hit the consumers hard. But there are also other structural problems from before the crisis. Inadequate historical expansion of electricity capacity has meant that the country has one of Asia’s highest electricity prices (currently 18-20 cents/kWh, about twice as high as in Vietnam). The infrastructure is underdeveloped, partly due to that the country consists of a large number of islands (7,641 to be exact). The majority of infrastructure projects have been concentrated on the largest island of Luzon (where Manila is located and approx. 60% of the population lives), while it has been more difficult to attract investment to the rest of the Philippines. Despite a young population, the Philippines has thus not managed to attract foreign direct investment to the same extent as e.g. China and Vietnam have previously succeeded. This has hampered the country’s exports, and since 2015, the Philippines has mostly run a current account deficit, which has put pressure on the currency and created risk aversion among foreign investors.

Despite the challenges, the Philippines (with the exception of 2020) has managed to maintain a growth rate of around 6% even in recent years. In 2023, growth reached 5.6%. On our trip, we met the Philippines’ leading company in renewable energy, AC Energy. The rise of renewable energy has given the Philippines a new chance to address the electricity shortage. AC Energy has taken a central role in the construction and plans to install 8 GW of new capacity until 2030, which can be compared to the Philippines’ total installed capacity of about 30 GW in 2023. It was a good discussion that also touched on future technologies, such as energy storage systems (the possibility of storing “the day’s harvest” of solar energy via batteries for use during the night).

We also got to see some of the ongoing infrastructure projects on site. Manila is a gigantic city (26 million inhabitants if you include nearby urban areas). Pasay City, located ten kilometers southwest of the city center itself, is the center of expansion in recent years. Here you can find the Philippines’ largest shopping center, Mall of Asia, and the world’s largest IKEA store. An impressive land reclamation project is also underway here, where an area of 360 hectares (Sri Lanka’s Port City is about 270 hectares) is being converted into new office and residential land. The fast-growing cities of South Asia are under constant change, and talented project developers can make previously uninteresting areas rise in rank. In times when there is a lot of talk about rising sea levels, the development of technology for more efficient land reclamation is an interesting topic of discussion. For example, Singapore’s reclaimed land today constitutes 22% of the country’s surface, and another 7-8% is planned to be added in the coming decades.

Both in our meetings with the portfolio companies and in subsequent discussions with local players, it is clear that the stock market’s dismal performance over the past 6-7 years has very little to do with fundamental factors. The companies are maintaining roughly the same growth as they showed a decade ago, and the growth in the economy is similar. One of our less successful investments in recent years has been our investment in Puregold (“The Lidl of the Philippines”). Today, the company has around 500 smaller grocery stores (each about 1500 square meters) and 30 larger grocery stores (a la CostCo, about 3000 square meters each). It increases the number of stores by 5-6% per year. In 2010-2014 the company was valued at 20-30x the annual earnings. Today the valuation has come down to 8x. Growth remains around 10% per year. There is no lack of competition. In fact, in the last year, competitors have been surfacing, especially in the low-price segment. This has created short-term pressure on the margins, but these are normal challenges in the food retailing business. Modern food retailing still accounts for only about 25% of the Philippines’ total consumption of groceries. Puregold is the second largest player but only has a 6% market share of total spending. That number can be compared with Sweden, where the largest player (ICA) has approx. 50% market share, followed by Axfood (21%) and Coop (17%). Puregold will be able to continue to grow at a decent pace in the decades to come, partly due to increasing Filipino consumption, and partly as a result of new openings and acquisitions. And even after the most expansive phase, grocery shopping doesn’t have to be a boring investment. Axfood shares have (calculated in USD) tripled in the last ten years and thus outclassed the Stockholm Stock Exchange. The largest grocery retailer ICA showed a similar development until it was bought out in 2022.

Puregold is a good example of the lack of interest in smaller emerging markets in recent years. It is of course possible to find arguments for the lack of interest and the lower multiples. In addition to the crises the country has gone through, its importance in the emerging market index has decreased, liquidity has decreased as local investors have sought other asset classes, etc. Buying back shares is not an effective method to increase the value in the long term, as liquidity is already a problem today, and lowering it will further antagonize foreign fund managers. The Philippines is not alone in having seen its stock market underperforming. The headlines surrounding smaller emerging markets have not been so cheerful in the Western media, to say the least. Just as we have pointed out regarding other of our markets, however, much is about foreign investors’ difficulties in separating the countries’ problems from the companies’ fundamental performance. We believe that with the crises of recent years now behind us, this concern should subside, which should mean that more investors decide to have a second look at markets such as the Philippines.

______________________________________________________________________

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you be able to recover all of your investment. Historical return is no guarantee of future return. The state of the origin of the Fund is Sweden. This document may only be distributed in or from Switzerland to qualified investors within the meaning of Art. 10 Para. 3,3bis and 3ter CISA. The representative in Switzerland is OpenFunds Investment Services AG, Seefeldstrasse 35, 8008 Zurich, whilst the Paying Agent is Società Bancaria Ticinese SA, Piazza Collegiata 3, 6501 Bellinzona, Switzerland. The Basic documents of the fund as well as the annual report may be obtained free of charge at the registered office of the Swiss Representative.