QUIET END TO A GOOD YEAR

In USD the fund fell 0.3% (EUR: +0.1%) in December, compared with MSCI FMxGCC Net TR (USD) which rose 0.4% (EUR: +0.8%) and MSCI EM Net TR (USD) which rose 1.1% (EUR: +1.5%). We experienced corrections in our largest positions where six of our seven largest holdings fell during the month. Measured in absolute return, it was former underperformer Egypt, who made a positive contribution. Our largest Egyptian position, GB Auto, rose 31% (USD) during the month after announcing a buy-back program. This triggered an initial revaluation where we believe that there is significantly more upside left. From a background as an auto assembler and dealer, the company has built an extensive financial services company around the vehicle business. Initially, they focused on auto financing, but gradually they’ve expanded to additional areas. The GB Capital business area can today be considered one of Egypt’s most exciting fintech companies – and it is also very profitable. We love the technological revolution that permeates our markets. We always list sponsors and management as the most important factor behind profitable growth. GB Auto’s evolution proves this once more. Egypt has had an extremely tough period with very high real interest rates, which attracted investors to the fixed income market instead of the stock market. In our eyes, this is the most important explanation for GB Auto’s valuation. Despite the share price rising 60% in 2021, the company is still valued at less than 5x the annual profit, with an expected profit growth of just under 50% (!) for the coming year. After adding to the position during the autumn, it is currently our eighth largest position with a portfolio weight of approximately 4%.

We also received positive contributions from the Vietnamese consumer conglomerate Masan Group which rose 15%, and the Indonesian hospital chain Hermina Hospitals which rose 9%. Our two largest Pakistani holdings, Systems Ltd and Meezan Bank, were the positions that weighed most during the month. Systems rebounded 5% and Meezan Bank fell back 9%. The declines should be seen against the background of the shares’ increases of 83% and 40% respectively in 2021, a year when the stock market (MSCI Pakistan IMI Net TR USD) fell 12% in the end.

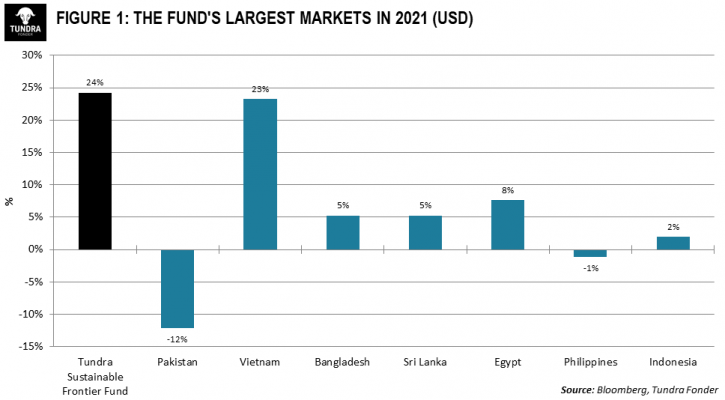

For the year as a whole, the fund rose 24.2%, which was 5.9% better than our benchmark index and 27% more than MSCI EM Net TR (USD). We view the fund as a good complement to, rather than a replacement of, a traditional emerging market fund, and in 2021 our point was proven. Despite a very strong year in the fund, the conditions were far from ideal. Our largest market, Pakistan, fell 12% and of the fund’s markets that weighed more than 5% during the year (approx. 86% of fund assets), none performed better than the fund as a whole (see Figure 1).

Despite two good years behind us in the fund (+24% and +28% respectively), the conditions, measured as market returns, have not been very good. Whether 2022 will be the year when this change remains to be seen. As usual, we have a long list of concerns. The last year’s rising commodity prices, in combination with logistics problems when the global economy picked up speed again after COVID-19, means that inflation worldwide is high from a historical perspective. As most of our important markets are large net importers of raw materials, this creates concerns with the trade balances in the short term. The problem is exacerbated in certain countries’ current account balances by the delayed recovery in global tourism.

Rising global inflation further forces the world’s central banks to consider tightening monetary policies, the most obvious of which are interest rate hikes. The single most significant discussion in 2022 is likely to be the actions of the US Federal Reserve and whether a more restrictive monetary policy dampens the almost uninterrupted rally in the United States over the past ten years. In our monthly letter for October, we argued that future increases in global policy rates are likely to have less impact in our markets than in the Western world; read more here.

Interest rate hike cycles in the US are traditionally described as negative for emerging and frontier markets. This is because it tends to attract capital to the US, away from more exotic markets. After more than 10 years of almost constant outflows from foreign investors who, given the low interest rates at home, preferred to invest in real estate and private equity structures in their home countries, one should probably ask oneself whether the appetite for emerging and frontier markets can deteriorate much further. We are hesitant about that. Rather, we see that local investors are getting used to the absence of foreign investors. It is easy to forget after ten fantastic years in the USA, where the S&P 500 gave an average annual return of 16.5% (USD), that the S&P 500 returned just under 3% annually between 2001-2011, compared to emerging markets (MSCI EM) which returned 14% during the same period.

We are not in the habit of predicting stock market crashes. For most long-term investors, equity markets will always be the best place to be. However, we do believe in rational asset allocation and trying to make sure the odds for reasonable returns are on your side. Theoretically, the most likely scenario is that emerging markets and frontier markets (smaller emerging markets) regain lost ground in the coming decade. We hope to be able to maintain our historical outperformance vs our benchmark of about 5% annually (after full management fee and other costs) even in such a scenario. With expectations of better market conditions, it’s hard not to be a bit excited about the coming years. We are entering 2022 with an average portfolio valuation of just under 10x annual profits and with an expected profit growth in the coming year of 18%.

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you be able to recover all of your investment. Historical return is no guarantee of future return. The state of the origin of the Fund is Sweden. This document may only be distributed in or from Switzerland to qualified investors within the meaning of Art. 10 Para. 3,3bis and 3ter CISA. The representative in Switzerland is OpenFunds Investment Services AG, Seefeldstrasse 35, 8008 Zurich, whilst the Paying Agent is Società Bancaria Ticinese SA, Piazza Collegiata 3, 6501 Bellinzona, Switzerland. The Basic documents of the fund as well as the annual report may be obtained free of charge at the registered office of the Swiss Representative.